The Main Principles Of Property By Helander Llc

The Main Principles Of Property By Helander Llc

Blog Article

Little Known Questions About Property By Helander Llc.

Table of ContentsHow Property By Helander Llc can Save You Time, Stress, and Money.About Property By Helander LlcProperty By Helander Llc - An OverviewSome Ideas on Property By Helander Llc You Should KnowSee This Report about Property By Helander LlcUnknown Facts About Property By Helander Llc

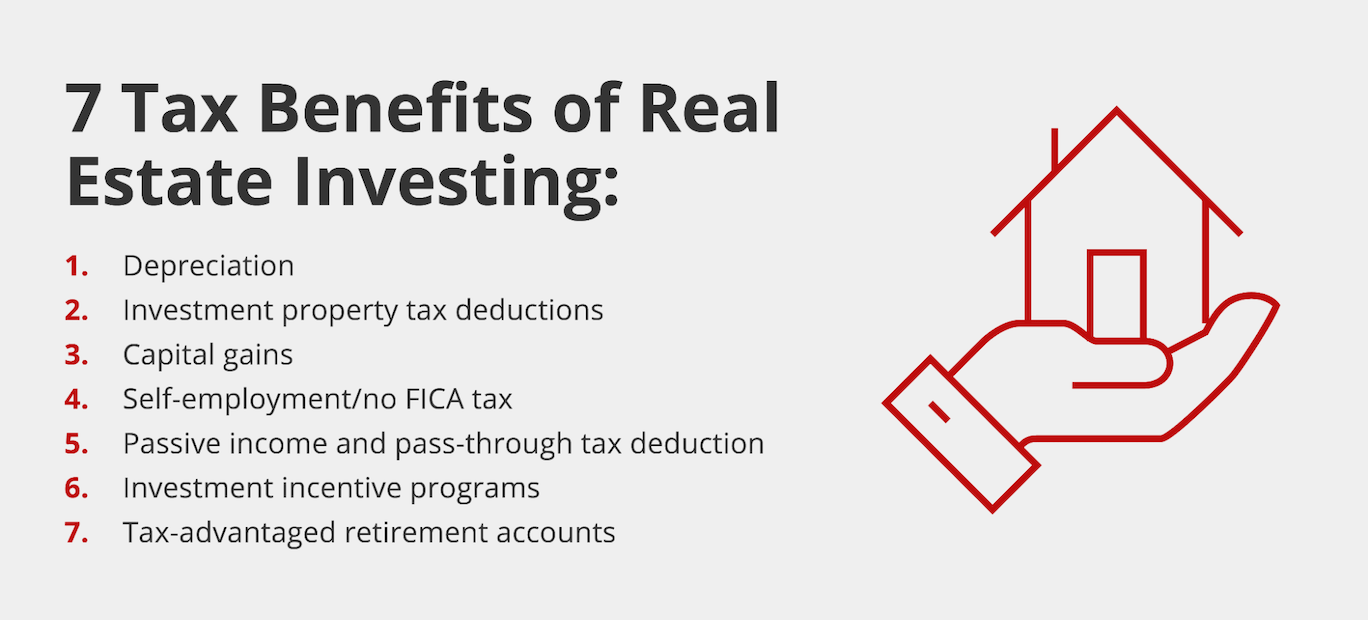

The benefits of investing in genuine estate are numerous. With well-chosen possessions, investors can delight in predictable money circulation, excellent returns, tax advantages, and diversificationand it's possible to take advantage of genuine estate to build riches. Thinking of spending in property? Below's what you require to know regarding property benefits and why property is considered an excellent investment.The benefits of buying actual estate include passive earnings, secure capital, tax advantages, diversity, and take advantage of. Realty financial investment counts on (REITs) supply a method to spend in property without needing to own, run, or financing properties - (https://www.kickstarter.com/profile/pbhelanderllc/about). Capital is the earnings from a property investment after mortgage settlements and overhead have been made.

In most cases, money circulation just enhances over time as you pay down your mortgageand develop up your equity. Investor can make use of numerous tax obligation breaks and reductions that can save cash at tax time. Generally, you can subtract the reasonable costs of owning, operating, and taking care of a property.

Everything about Property By Helander Llc

Genuine estate worths tend to raise with time, and with a great financial investment, you can make a profit when it's time to sell. Rental fees also tend to rise gradually, which can cause higher capital. This graph from the Reserve bank of St. Louis shows average home rates in the U.S

The areas shaded in grey suggest united state economic downturns. Average Sales Price of Houses Offered for the USA. As you pay down a home home mortgage, you build equityan property that belongs to your total assets. And as you develop equity, you have the take advantage of to buy even more properties and enhance money circulation and wide range even extra.

Due to the fact that property is a substantial possession and one that can function as collateral, financing is easily available. Realty returns vary, depending on factors such as location, asset course, and monitoring. Still, a number that several financiers intend for is to defeat the ordinary returns of the S&P 500what lots of people describe when they claim, "the market." The inflation hedging ability of realty stems from the favorable connection between GDP growth and the need genuine estate.

Property By Helander Llc Things To Know Before You Get This

This, in turn, converts right into higher resources values. Actual estate tends to maintain the buying power of funding by passing some of the inflationary pressure on to occupants and by including some of the inflationary stress in the kind of resources appreciation - Sandpoint Idaho land for sale.

Indirect real estate spending includes no straight ownership of a property or residential properties. There are several means that having genuine estate can shield versus inflation.

Properties financed with a fixed-rate financing will see the relative amount of the monthly home loan settlements fall over time-- for instance $1,000 a month as a fixed repayment will certainly come to be less difficult as rising cost of living wears down the buying power of that $1,000. (https://www.cybo.com/US-biz/property-for-sale_9n). Commonly, a main house is ruled out to be a real estate investment given that it is utilized as one's home

The Ultimate Guide To Property By Helander Llc

Also with the assistance of a broker, it can take a few weeks of job simply to discover the ideal counterparty. Still, actual estate is a distinctive property class that's simple to understand and can enhance the risk-and-return profile of a financier's profile. By itself, property supplies capital, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge against inflation.

Purchasing actual estate can be an extremely gratifying and rewarding endeavor, yet if you resemble a great deal of new capitalists, you may be wondering WHY you need to be buying property and what advantages it brings over various other financial investment chances. Along with all the remarkable advantages that occur with buying real estate, there are some downsides you require to consider as well.

Getting My Property By Helander Llc To Work

At BuyProperly, we make use of a fractional ownership design that allows capitalists to Read Full Article begin with as little as $2500. One more significant advantage of real estate investing is the capability to make a high return from purchasing, remodeling, and marketing (a.k.a.

Most flippers a lot of fins undervalued buildings in great neighborhoods. The terrific thing regarding spending in genuine estate is that the worth of the residential or commercial property is expected to value.

The 6-Second Trick For Property By Helander Llc

As an example, if you are charging $2,000 lease per month and you incurred $1,500 in tax-deductible expenses per month, you will only be paying tax on that particular $500 profit per month. That's a large difference from paying taxes on $2,000 per month. The profit that you make on your rental for the year is taken into consideration rental revenue and will be tired accordingly

Report this page